A longer collection period might indicate financial distress, as it could mean customers are struggling to pay their bills, or the company is not enforcing its collection terms strictly enough. Consequently, it represents a higher degree of credit risk, which could deter potential investors and lenders. In addition to its role in assessing operational efficiency, the average collection period also has implications for the overall financial health of a business. Predominantly, it is a useful tool for investors and lenders to understand a company’s liquidity position. The second component of the formula, Average Daily Sales (ADS), represents the average amount of daily sales generated by the business.

Average Collection Period: Formula, Examples, Ways to Improve

The ACP figure is also a good way to help businesses prepare an effective financial plan. You can consider things such as covering costs and scheduling potential expenses in order to facilitate growth. We’ll take a closer look at the definition, the formula, and give you an example of the ACP in play.

- As such, it is acceptable to use the average balance of AR over the same period of time as covered in the income statement.

- On the contrary, a company with a long collection period might be offering more liberal credit terms or might not be enforcing its collections process strictly.

- With less working capital, a company may struggle to pay off its short-term liabilities, thus putting pressure on its liquidity.

- In that case, the formula for the average collection period should be adjusted as needed.

Improving Average Collection Period: Best Practices

In conclusion, the average collection period plays a crucial role in determining a company’s financial health. It directly impacts the company’s cash flow, liquidity, working capital management, and even its potential for growth and stability. Therefore, businesses should aim to keep their average collections period as short as possible.

Set Alerts for Long ACP

As you can see, it takes Devin approximately 31 days to collect cash from his customers on average. The average collection period should be used in your financial model to accurately forecast how and when new customers will contribute to your cashflow. With Mosaic, you can also get a real-time look into your billings and collections process. Since Mosaic offers an out of the box billings and collections template, you can automatically surface outstanding invoices by due date highlighting exactly where to focus your collection efforts. Companies prefer a lower average collection period over a higher one as it indicates that a business can efficiently collect its receivables.

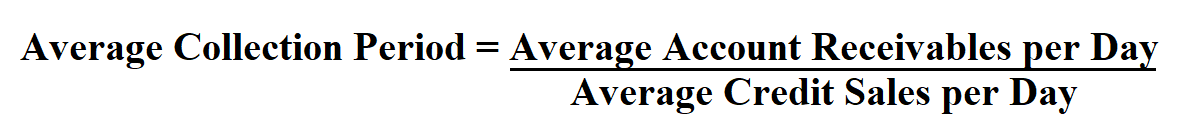

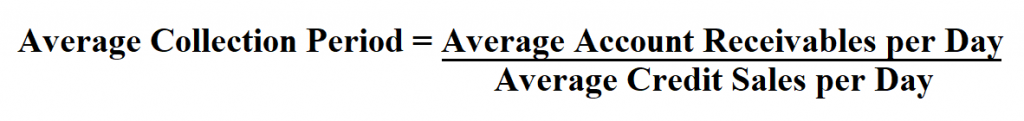

A company would use the ACP to ensure that they have enough cash available to meet their upcoming financial obligations. As we’ve said before, the average collection period offers limited insights when analyzed in isolation. 🔎 You can also enter your terms of credit in our calculator to compare them with your average collection period. In that case, the formula for the average collection period should be adjusted as needed. Knowing the average collection period for receivables is very useful for any company. The company’s top management requests the accountant to find out the company’s collection period in the current scenario.

In the first formula, we first need to determine the accounts receivable turnover ratio. Once a credit sale happens, the customers get a specific time limit to make the payment. Every company monitors this period and tries to keep it as short as possible so that the receivables do not remain blocked for a long time. Real estate and construction companies also rely on steady cash flows to pay for labor, services, and supplies. Timely follow-ups on outstanding invoices can also enhance your average collection period. Regular reminders to customers about their due payments can prevent past-due accounts from extending too far beyond their due dates.

This metric should exclude cash sales (as those are not made on credit and therefore do not have a collection period). Keep in mind that slower collection times could result from poor customer payment experiences, such as manual data entry errors or slow billing payment processes. The monitoring of the average collection period is one way to track a company’s ability to collect its accounts receivable. This comparison includes the industry’s standard for the average collection period and the company’s historical performance.

The terms of credit extended to customers also play an integral part in determining the collection period. A business that offers extensive credit terms, such as ‘net 90 days’, will naturally have a longer average collection period than a business that insists on ‘net 30 days’. Industries that serve big businesses or government agencies accounts payable and invoice automation best practices may offer these longer terms as a competitive advantage, pushing out their collection periods. The average collection period’s impact extends to the overall stability and growth of a business. Ideally, a company strives to maintain a balance where it can collect its receivables quickly and defer its payables for as long as possible.

لراوبر ویب پاڼه لراوبر يو افغان – تازه خبرونه

لراوبر ویب پاڼه لراوبر يو افغان – تازه خبرونه