In other words, its current assets are reducing, subsequently shrinking its working capital. With less working capital, a company may struggle to pay off its short-term liabilities, thus putting pressure on its liquidity. For instance, if a company’s ACP is 15 days but the industry average is closer to 30, it may indicate the credit terms are overly strict.

Average Collection Period: Understanding Its Importance in Business Finance

- For instance, it may indicate lax credit policies, where customers are not encouraged to pay on time.

- While a shorter average collection period is often better, too strict of credit terms may scare customers away.

- This financial indicator should be paid attention to by organizations whose cash flows largely depend on the funds received from the credit sales.

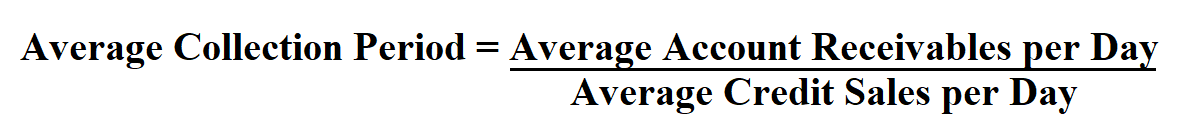

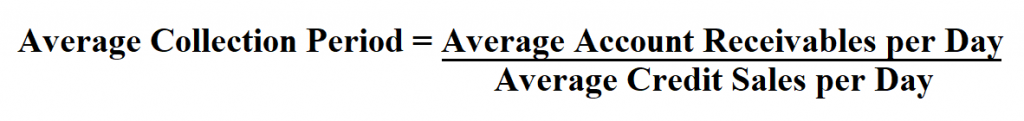

- Finally, to find the value of the average collection period, you will need to divide the average AR value by total net credit sales and multiply the result by the number of days in a year.

- We’ll take a closer look at the definition, the formula, and give you an example of the ACP in play.

They examine their financials and find that their average receivables balance over a year is $50,000, and their annual credit sales are $600,000. A company’s average collection period gives an insight into its AR health, credit terms, what is an invoice and how do i make one and cash flow. Without tracking the ACP, it will become difficult for businesses to plan for future expenses and projects. Here are two important reasons why every business needs to keep an eye on their average collection period.

What Is Average Collection Period? – Formula and How to Calculate It

💡 To calculate the average value of receivables, sum the opening and closing balance of your required duration and divide it by 2. You can also open the Calculate average accounts receivable section of the calculator to find its value. 🔎 Another average collection period interpretation is days’ sales in accounts receivable or the average collection period ratio.

Utilizing the average collection period metric to skyrocket your cash flow

A longer average collection period signifies that a company is more lenient or slower in collecting its receivables. This scenario causes funds to be tied up in debtors for an extended period, potentially leading to cash flow issues. A firm with cash flow problems may struggle to meet its operational and financial obligations like payroll, inventory purchases, and loan payments.

In summary, both long and short collection periods present their own financial and reputational challenges. Companies need to strike a balance between receivable collection and maintaining good customer relationships, while ensuring adequate liquidity for operations and growth opportunities. Simply put, too long or too short an average collection period could put the long-term sustainability of the firm at risk. Therefore, effective and strategic management of the collection period is crucial for a company’s financial health and reputation. Therefore, management often carefully monitors the ACP as part of their overall performance assessment. They aim to strike a balance, ensuring there are good cash flows without damaging customer relations due to stringent credit terms and collection practices.

The significance of an organization’s average collection period is rooted in its ability to assess the efficiency of its accounts receivable (AR) management practices and maintain adequate cash flow. By interpreting this metric, businesses gain valuable insights into their liquidity position, financial health, and competitive standing. In this section, we will discuss how to read and analyze an average collection period to glean meaningful information for your business.

Average collection period refers to the amount of time it takes for a business to receive payments owed by its clients in terms of accounts receivable (AR). Companies use the average collection period to make sure they have enough cash on hand to meet their financial obligations. The average collection period is an indicator of the effectiveness of a firm’s AR management practices and is an important metric for companies that rely heavily on receivables for their cash flows. The average collection period is an important accounting metric that evaluates a company’s ability to manage its accounts receivable (AR) effectively. It measures the time it takes for the business to collect payments from its clients, which reflects its cash flow effectiveness and ability to meet short-term financial obligations. Benefits of a Low Average Collection PeriodA low average collection period signifies several advantages for companies.

Efficient and ethical management of the average collection period signals a corporation’s alignment with socially responsible financial practices. The average collection period focuses on the time it takes a company to receive payments due from its customers. This payment process and its eventual speed is deeply intertwined with a company’s CSR commitments. Stricter credit policies typically lead to a shorter average collection period because they reduce the risk of lending to customers with poor creditworthiness. On the other hand, overly strict policies could deter potential customers, so it’s a delicate balance.

The days sales outstanding calculation, also called the average collection period or days’ sales in receivables, measures the number of days it takes a company to collect cash from its credit sales. This calculation shows the liquidity and efficiency of a company’s collections department. Industry comparisons can also reveal how credit terms impact collections performance. Companies with shorter credit terms and quicker payment cycles may benefit from reduced DSO and improved cash flow.

On the other hand, a fast collection period can simply mean that a company has established strict credit terms. While such terms may work for some clients, they may turn others away, sending them in search of competitors with more lenient payment rules. For example, suppose a company has an average collection period of 25 days, and they have $100,000 in AR, which is 20 days old. Calculating the average collection period and keeping it relatively low allows businesses to maintain liquidity. It also provides the management with a general idea of when they might be able to make larger purchases.

In conclusion, understanding the average collection period is essential in monitoring a company’s cash flow and overall financial performance. Regularly calculating this metric provides valuable insights into your organization’s receivables management practices and helps identify opportunities for improvement. The Accounts Receivable Turnover ratio is calculated by dividing the total net credit sales by the average accounts receivable. The faster the turnover, the shorter the collection period, which indicates efficient credit sales management. Conversely, a low average collection period typically suggests that a company efficiently collects its receivable balances.

لراوبر ویب پاڼه لراوبر يو افغان – تازه خبرونه

لراوبر ویب پاڼه لراوبر يو افغان – تازه خبرونه