Posts

Credit are allowed on condition that you can get effectively linked income. For individuals who did not have an enthusiastic SSN (otherwise ITIN) awarded on the or until the deadline of one’s 2024 come back (along with extensions), you cannot allege the kid taxation borrowing to your both their brand-new otherwise a revised 2024 go back. You may also be eligible for so it credit (also known as the new saver’s borrowing from the bank) if you produced eligible benefits in order to a manager-backed retirement plan or even to a keen IRA within the 2024. To find out more concerning the requirements so you can claim the financing, come across Club. While you are a citizen alien, a great being qualified based includes your own being qualified son or qualifying cousin.

As we can get earn income of names noted on this amazing site, all of our reviewers’ views are always their and are perhaps not swayed because of the economic element in in any manner. All of our writers review the newest names in the player’s direction and provide their feedback, one continue to be unedited. This allows me to upload objective, objective and you may true analysis. One another to find short term house and long lasting residency, there’s no lowest income demands. Short term residency offers the legal right to live and work in Paraguay, and also to end up being subject to Paraguayan taxation for 2 years.

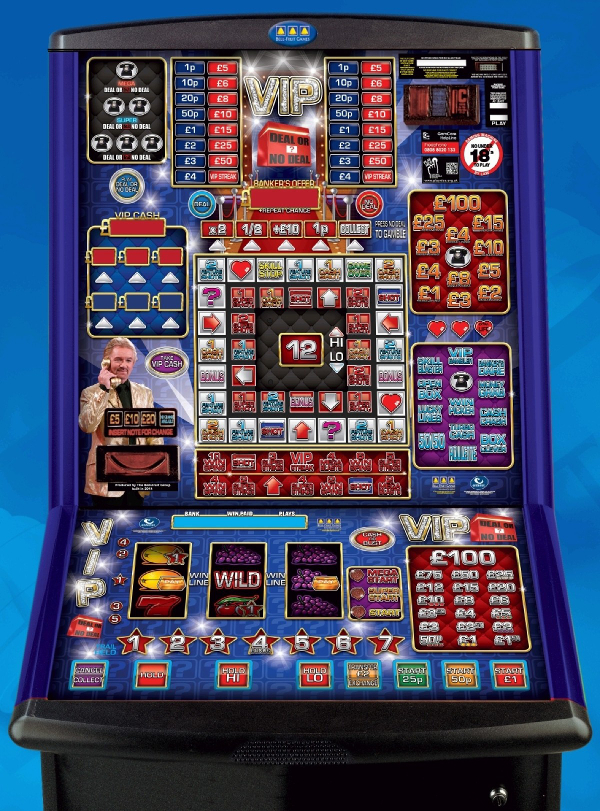

So what can a property manager deduct out of shelter deposits?: casino Fire Strike

It is extremely essential that you read the casino’s conditions and terms just before registering or and make a deposit, which means you know exactly what you are getting into and you can choose the best gambling enterprise to you personally. If your gambling establishment have a bonus available that accompanies totally free revolves, We don’t casino Fire Strike see the reason you shouldn’t be capable of geting him or her, so long as you meet with the local casino’s criteria. As you is duplicate so it checklist general, we recommend listening to the regional field. If you know to possess an undeniable fact that your own hardwood boy fees $step 1,100000 for every place, generate one to known to their occupant. More direct you’ll be today, the brand new a lot fewer astonished renters your’ll manage later.

$5 Minimal Deposit Casino NZ – Put 5 rating one hundred 100 percent free revolves

The tenant accounts for the full cost of unpaid rent and you can injuries, even though their put isn’t sufficient. Usually, a month’s book try fundamental, however in higher-consult components, you are in a position to request more. An appropriate shelter put amount hinges on the rental’s venue and you can county laws and regulations. Both, renters might query to use element of the put for rent, quick fixes, or perhaps to defense outstanding debts when they’re short to your cash. Getting your brand-new target is one of the most extremely important shelter deposit regulations that you must go after.

Next talks will allow you to know if money you can get inside the income tax 12 months is actually effortlessly related to a You.S. change otherwise organization and exactly how it’s taxed. So it exemption doesn’t apply to compensation to have functions did on the foreign flights. The decision to end up being handled as the a citizen alien try frozen for your tax year (pursuing the tax 12 months you made the option) in the event the neither mate are an excellent U.S. citizen or citizen alien when inside the income tax seasons. It indicates per spouse must document another go back because the a good nonresident alien for this season if the sometimes matches the brand new filing requirements to possess nonresident aliens chatted about inside the chapter 7. Nonresident alien college students from Barbados and you may Jamaica, along with students of Jamaica, will get be eligible for a keen election getting treated since the a citizen alien for U.S. taxation motives within the U.S. taxation treaties that have those individuals places. If you qualify for which election, you may make they from the processing a questionnaire 1040 and you will attaching a finalized election report on the return.

Platforms such Qira provide big benefits to one another people and you can assets professionals. Citizens reach remain more cash within pockets, and you can assets professionals wear’t need suppose any extra chance—Qira covers it in their mind. Possessions professionals are allowed to costs to have defense deposits or the basic week’s lease initial, nevertheless they may no lengthened charges a rental app commission. They are also banned to charges flow-in the costs or flow-away costs.

To help you claim the fresh deduction, go into an excellent deduction from $3,000 otherwise smaller on line 15b otherwise a deduction from more than simply $step three,000 on the web 15a. Should your fiduciary elects when planning on taking the credit as opposed to the deduction, it has to utilize the Ca income tax speed, add the borrowing amount to the entire on line 33, Total Money. Left for the complete, generate “IRC 1341” and the amount of the financing. Enter the overall nonexempt money not stated elsewhere for the Top step one. See the field if it Form 541 will be registered as the a protective allege to own reimburse.

For individuals who amend Setting 1040-NR otherwise file a correct go back, enter into “Amended” over the better, and you will install the brand new fixed go back (Form 1040, 1040-SR, otherwise 1040-NR) to create 1040-X. Ordinarily, a revised come back stating a refund have to be registered within this step three years from the date your own return try recorded otherwise inside 2 years ever since the newest taxation is paid back, almost any is later on. An income submitted before last due date is recognized as so you can had been registered to the deadline. Once you submit their income tax go back, take special care to get in a proper amount of any income tax withheld shown in your advice data. Next table lists a few of the more widespread suggestions data files and you may reveals finding the degree of income tax withheld. To claim the brand new adoption borrowing from the bank, file Form 8839 with your Setting 1040-NR.

Bank account helps you control your money in flexible suggests. Start out with Financial Smartly Examining to discover rewards and additional professionals as your balances expand. Just browse up-and discover all of our set of the best $5 deposit casinos inside Canada. All of our subscribers who sign in at the Jackpot Urban area can be receive a welcome added bonus as much as $1,600.

لراوبر ویب پاڼه لراوبر يو افغان – تازه خبرونه

لراوبر ویب پاڼه لراوبر يو افغان – تازه خبرونه